In this article…

- Income tax

- Dividend income

- National Insurance changes

- Capital Gains Tax

- Inheritance Tax

- Individual Savings Accounts (ISAs)

- Enterprise Investment Scheme (EIS) and other investments.

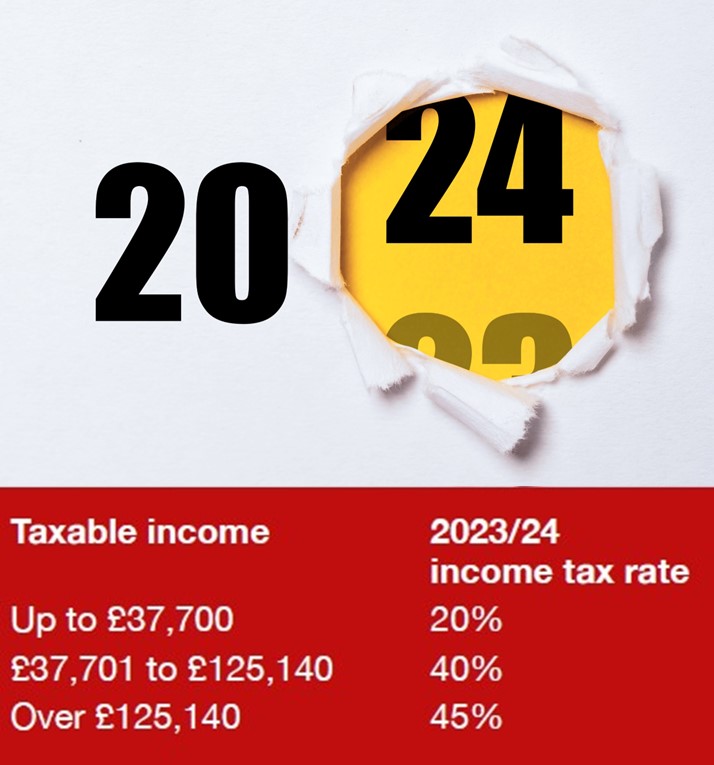

Income Tax

If your income falls just above one of the income tax thresholds below, you may want to reduce your taxable income, for example, by paying into your pension or giving money to charity.

You may also want to make use of the personal allowance (still £12,570) for family members with no taxable income.

You should take particular care if your income is in the £100,000 to £125,140 range, as your personal allowance is reduced by £1 for every £2 over £100,000.

Also be aware that from 6 April 2023, the 45% additional rate threshold was reduced from £150,000 to £125,140. This means salary increases and bonuses given this year may cause some people to move into a new taxable bracket.

You can get income tax relief in 2023/24 for gift aid donations made by 5 April 2024 or, by election, for cash gift aid made by 31 January 2025 before filing your 2023/24 tax return.

Income tax relief is also available on gifts of quoted shares and land to charity, but only for the year in which the gift is made. There is no capital gains tax liability or inheritance tax liability on such gifts.

The lifetime allowance for pension savings for 2023/24 is still £1,073,100 and is due to remain frozen at this level until the 2025/26 tax year – if the current government remains in place.

You can contribute up to £60,000 (gross) into a pension scheme. This allowance may be reduced for any individuals whose adjusted income is more than £260,000.

Personal pension contributions attract basic rate tax relief at source and therefore the £60,000 gross contribution only requires a £48,000 personal payment.

In addition, the pension contribution increases your basic rate threshold. So, if you’re a higher or additional rate taxpayer, you will receive additional tax relief on the contribution made via your tax return.

Furthermore, the pension contributions effectively increase the threshold at which the personal allowance is reduced, and Child Benefit is clawed back.

So, if your income is more than £100,000, pension contributions can preserve part or all your personal allowance depending on your circumstances.

For anyone with income between £100,000 and £125,140, pension contributions can provide tax relief at an effective rate of 60%.

If you have held a pension scheme in previous years and didn’t fully utilise your allowance in any of the previous three tax years, any unused allowance is available this year. Contributions made by your employer, or your company also count towards your allowance.

Dividend Income

From 6 April 2023 the dividend tax-free allowance halved to £1,000 and is due to halve again in 2024/25 to £500. You may want to factor this into your planning. The tax position on dividend income is as follows:

| Dividend allowance at 0% | 2023/24 | 2024/25 |

| All individuals | £1,000 | £500 |

| Tax rates on dividend income above the threshold | 2023/24 | 2024/25 |

| Basic rate taxpayers | 8.75% | 8.75% |

| Higher rate taxpayers | 33.75% | 33.75% |

| Additional rate taxpayers | 39.35% | 39.35% |

You could save tax if your company pays you a dividend in place of salary in the current tax year.

National Insurance Changes

Don’t forget to factor into your budgeting the recently announced changes to national insurance contributions (NICs):

- From 6 January 2024, the employees Class 1 rate will be cut by 2 percentage points from 12% to 10%.

- From 6 April 2024 for the self-employed, Class 2 will be abolished. Class 4 will reduce from 9% to 8% on all earnings between £12,570 and £50,270.

Capital gains tax (CGT)

From 6 April 2023, the annual exempt amount for individuals and personal representatives reduced to £6,000. It will halve to £3,000 in 2024/25.

The annual exempt amount for most trusts was cut to £3,000 (minimum £600) in 2023/24 and will also halve in the following year.

If any of your assets have become of negligible value, such as shares in companies that have gone into administration, you should consider a loss claim. In the case of shares you have subscribed for in unlisted trading companies, income tax relief may be available.

For non-UK domiciled individuals who are remitting an arbitrary annual exemption amount each year, it is now advisable to conduct a review of how much is being remitted.

Remember, the deadline to report and pay CGT after selling UK residential property is 60 days after completion.

‘Bed and breakfasting’ (i.e., selling shares or securities to realise a gain covered by losses or the annual exemption and then buying them back), is not allowed if the purchase takes place within 30 days. These rules don’t apply however to shares ‘reacquired’ by your spouse or ISA.

Disposals of qualifying shares that result in a controlling interest in a company being held by an employee ownership trust are exempt from CGT.

Inheritance tax (IHT)

The IHT nil rate band will remain at £325,000 until 2027/28. The residence nil rate band (RNRB) also stays at £175,000, and the RNRB taper will continue to apply where the value of the deceased’s estate is greater than £2m.

Exemption from IHT on lifetime gifts normally depends on surviving at least seven years, but there are exceptions. You can give up to £3,000 in total each tax year to anyone, plus the amount of any unused allowance from the preceding year.

In addition, you can give up to £250 each to any number of people each year (but they cannot be the same people who received gifts from the £3,000 annual gift allowance). Gifts of assets that grow in value can save IHT – even if you die within seven years – because the growth in value is in the recipient’s estate, not yours.

Regular gifts out of income are exempt from IHT with no limit, provided your remaining after-tax income is sufficient to maintain your usual standard of living. However, gifts can result in a CGT liability.

Individual Savings Accounts (ISAs)

No tax is payable on income or gains on investments within an ISA. You can invest up to £20,000 in total this tax year. The corresponding limit for junior ISAs (JISAs) and child trust funds (CTFs) is £9,000.

A surviving spouse or civil partner may claim an extra ISA allowance equal to the value of ISA holdings of a deceased partner if they live together at the time of death.

The Lifetime ISA is available for those saving to buy their first home. If you’re aged between 18 and 40, you can save up to £4,000 a year until you reach the age of 50 and receive a government bonus of 25% on your savings used towards the cost of a first home worth up to £450,000. The money can be invested as cash or in stocks and shares, as with other ISAs, and may be taken out tax-free after the investor is 60.

Enterprise Investment Scheme (EIS) and other investments

Provided you’re not ‘connected’ with the company, you can get income tax relief at 30% on up to £1m subscribed for shares in qualifying EIS companies each tax year and up to a further £1m for shares in ‘knowledge-intensive EIS companies’.

Any gain on the sale of the shares is exempt from CGT if they are held for at least three years. It’s possible to ‘carry back’ all or part of the investment to the preceding tax year if the limit for relief is not exceeded for that year.

Income tax relief at 50% is available on up to £200,000 in the current tax year in subscribed for shares issued by smaller companies qualifying for Seed Enterprise Investment Scheme (SEIS) relief. Again, provided the shares are held for at least three years, any gains on sale are exempt from CGT.

Subject to timing, CGT can generally be deferred by making EIS or SEIS investments, even if you’re connected with the company.

Income tax relief at 30% is available on up to £200,000 each tax year in subscribed-for shares in Venture Capital Trusts (VCTs), provided the shares are held for at least five years.

Dividends and gains relating to shares in VCTs are exempt, subject to limits on the size of your holding. Income tax relief at 30% is available on an investment of up to £1m in ‘social enterprises’.

Can we help?

With many thresholds frozen in the 2023/24 tax year, it’s important to check income increases don’t tip you into higher tax brackets. Do chat with your Shipleys contact or one of the specialists shown on this page for further guidance and help.

Specific advice should be obtained before taking action, or refraining from taking action, in relation to this summary. If you would like advice or further information, please speak to your usual Shipleys contact.

Copyright © Shipleys LLP 2023