This page was last updated on November 29, 2023

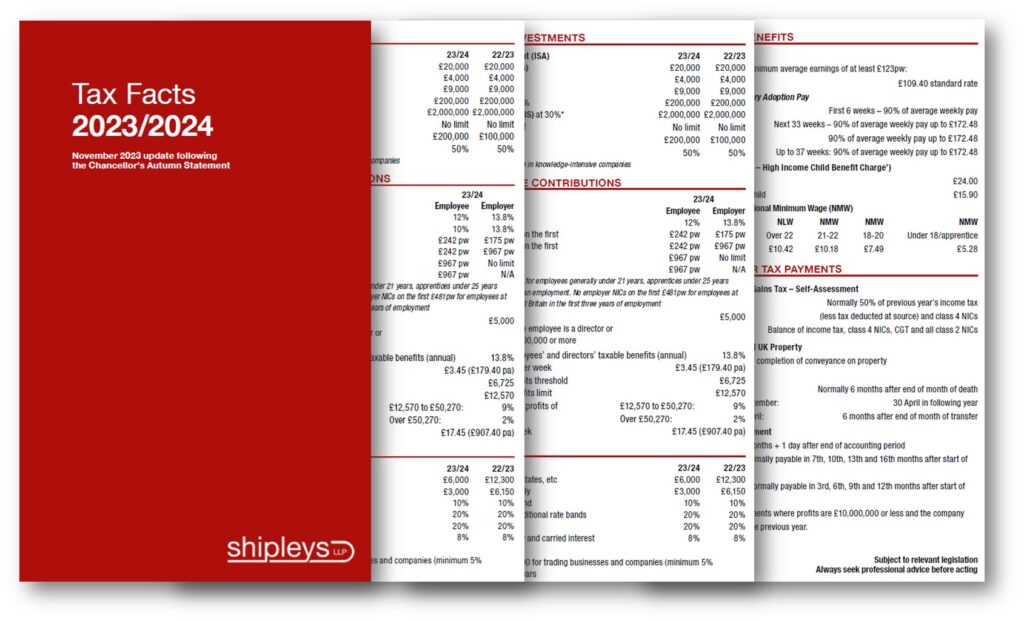

Our Tax Facts summary for the tax year 2023/24 gives all the rates and deadlines and is current according to the date shown on this page.

It also reflects the announcements in The Chancellor’s Autumn Statement on 22 November 2023.

Other helpful resources

You may also find the following resources helpful:

A SUMMARY OF THE CHANCELLOR’S 2023 AUTUMN STATEMENT

A SUMMARY OF THE CHANCELLOR’S SPRING BUDGET 2023

Can we help?

Please do get in touch with your usual Shipleys’ contact if you need any further advice or call one of our offices.

London – t: +44 (0)20 7312 0000 – e: advice@shipleys.com

Godalming – t: +44 (0)1483 423607 – e: godalming@shipleys.com

Specific advice should be obtained before taking action, or refraining from taking action, in relation to this summary. If you would like advice or further information, please speak to your usual Shipleys contact.

Copyright © Shipleys LLP 2023