Simon Robinson’s Viewpoint

Little by Little

It’s so good to see more positive signs blossoming as the UK tentatively emerges from lockdown.

With the vaccination programme’s continued roll-out and the Government’s roadmap for easing restrictions currently on target, it seems as if we can now look forward to a more social way of life and the rebuilding of the economy.

For that to happen, confidence is key. In April, the Federation of Small Businesses reported small businesses were gaining confidence with close to 60% expecting their performance to improve this quarter. Through our APA association we have also recently conducted a survey, the results of which are due to be published in the coming month. Please look out for the findings.

With you there to help me

For some time yet though recovery will be reliant on government support and on page 4 you’ll find a round-up of the latest measures in place. On the upside, fresh grants and the new recovery loans are in place. If you took out a Business Bounce Back loan, the Government’s Pay as You Grow initiative enables you to delay repayments or extend the loan period.

In the film and television production industry, there’s also been welcome news as the Restart Grant scheme has been extended to the end of December.

For our clients in the charity sector, the Fundraising Regulator has issued fresh guidance as charities resume public fundraising with the easing of lockdown restrictions. You can find a summary in our latest Charity Update.

Organisations benefiting from the furlough scheme should be mindful though that it will start to taper off in the summer before closing in September.

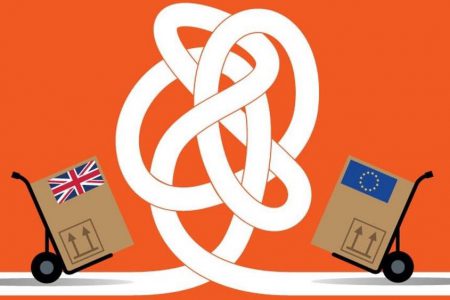

With or without you

Of course, not all the challenges this year have stemmed from the pandemic. The adjustments to international trade following Brexit have not gone smoothly. The Office for National Statistics reported that UK gross domestic product (GDP) and total exports dropped by 7.8% and 10.3% respectively in February 2021 compared to February 2020.

While new trading procedures are in place, some have also been delayed. On pages 6 and 7 of the magazine we’ve summarised the current state of play for those looking to export or source via Europe.

Brexit is also affecting individuals overseas with UK interests. On page 10, we’ve touched on recent developments such as the closing of UK bank accounts of non-residents, as well as the new immigration rules.

Are friends electric?

As I write this, a number of countries have publicised their environmental targets and this November Glasgow will host the UN’s 26th Climate Change Conference. With the past year dominated by the pandemic, it’s good that sustainability is once again in focus. Renewable energy is a sector we’re very familiar with as we support many businesses is this important and growing industry – see page 9.

Come together

Another positive that has emerged from the lockdown has been greater recognition to support people’s wellbeing. While remote working brings many benefits for some organisations, it also brings challenges in the form of excessive screen time, employee isolation and burnout. Earlier this year, our Business Club (which meets via Zoom) discussed wellbeing essentials to help businesses in 2021. See page 9 for some helpful suggestions.

I have been particularly impressed by how my Shipleys colleagues have adapted to the changes of the past year and maintained our levels of service and standards.

Congratulations to those of you who are celebrating recent exam successes and promotions.

I sincerely hope the next few months are better for everyone than the last. Don’t forget our team’s experience and expertise are here to support you and please do reach out. We’re keen to help.

In the meantime, enjoy the read.

Simon