Less than 4 months on from his Budget, and not yet in the job for five months, Rishi Sunak took to the stand again to deliver a fresh financial statement and set of measures. Of course, the past turbulent months warranted further action to rebuild the Economy and give hope to businesses.

8 July 2020

In the Summer Statement, a lot of the Chancellor's focus therefore concentrated on job protection and creation. It also looked to bolstering sectors struggling the most from the Coronavirus lockdown. Here is an overview of the key measures announced, and we'll be giving updates as fresh details emerge.

Key takeaways from the Statement

A £1,000 Job Retention Bonus to be introduced when the Coronavirus Job Retention Scheme ends for retaining employees who have been furloughed.

A new Kickstart Scheme will cover employers’ costs for new six-month work placements for trainees aged 16-24.

A £1,000 payment will be made to employers for each 16-24-year-old on work placement and training.

Employers who hire new apprentices will receive payments of up to £2,000.

There will be a temporary cut to Stamp Duty Land Tax on residential property, increasing the zero-rate band to £500,000, saving purchasers up to £15,000.

The rate of VAT will be cut temporarily from 20% to 5% for restaurant, food, accommodation and attractions businesses.

An ‘Eat Out to Help Out’ Scheme will offer 50% meal discounts during August, up to £10 per person dining including children.

The current economic landscape

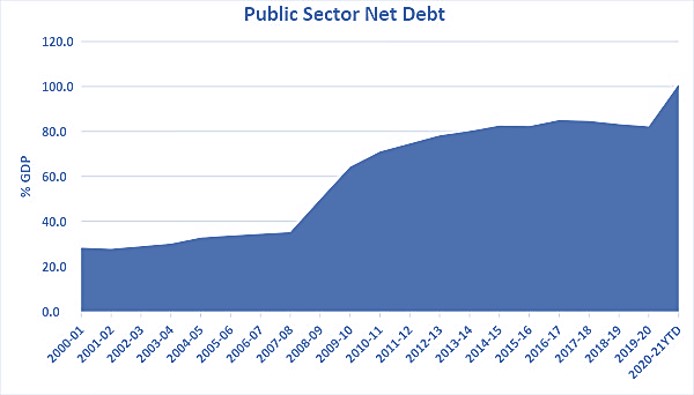

Rishi Sunak's latest statement was perhaps the most difficult, given the circumstances in which it was set. The government finances are in deep deficit. In the first two months of the current financial year, the Treasury borrowed £103.7 billion, which was over six times as much as in the same period in 2019/20 and close to double the Budget forecast for the entire year. In May, for the first time since 1963, total government debt exceeded 100% of GDP the UK’s economic output for the whole year.

Source:OBR

The UK economy contracted by 2.2% in the first quarter of 2020, according to the Office for National Statistics (ONS). In April alone – the first full month of lockdown – the ONS estimates that there was a further 20% shrinkage in output.

The Chancellor’s flagship employee furlough scheme, the Coronavirus Job Retention Scheme (CJRS), will start to be phased out in August. At that point, employers become responsible for the pension contributions and National Insurance Contributions (NICs) currently met by the Treasury. The CJRS, which has already been extended twice, has been confirmed to finish at the end of October. As of 5 July the scheme covered 9.4 million furloughed jobs provided by 1.1 million employers and had received claims totalling £27.4 billion.

The constituent parts of the UK are each emerging from lockdown, a process that could lead to an increased infection rate and local flare ups, as has happened in many US states, parts of Europe and Australia. On the day before the Chancellor’s statement, the Organisation for Economic Development published a report saying the UK unemployment rate could reach 14.8% by the end of 2020 if there is a second wave.

Plan for jobs

The challenge for the Chancellor in his Summer Statement was to start the transition from the emergency employment support that has so far been the focus of his strategy. He presented his statement as a ‘Plan for Jobs’, composed of three elements:

- Supporting

- Protecting

- Creating

The Chancellor placed a price tag on the measures of up to £30 billion. He also promised that in the Autumn Budget and Spending Review he would deal “with the challenges facing our public finances”. He is likely to start to balance the books, and tax rises – either explicit or by withdrawing reliefs – are almost inevitable, together with further announcements supporting the longer term recovery.

Supporting Jobs

The Chancellor announced a range of initiatives under the ‘Supporting Jobs’ heading, including:

Job Retention Bonus

The Chancellor made it clear that he intends to end the Coronavirus Job Retention Scheme (CJRS) in October as planned. To encourage employers to support those people who have been furloughed, a Job Retention Bonus will be introduced.

The Job Retention Bonus will provide a one-off payment of £1,000 to UK employers for every previously furloughed employee who remains continuously employed through to the end of January 2021. Employees must earn more than £520 a month on average between the end of the CJRS and the end of January 2021. Payments will be made from February 2021. Further details about the scheme will be announced by the end of July.

Kickstart Scheme

The Kickstart Scheme, which only covers Great Britain, aims to provide “hundreds of thousands of high quality six-month work placements” for those aged 16-24, who are on Universal Credit and are considered to be at risk of long-term unemployment.

Government funding for each job will cover 100% of the relevant National Minimum Wage for 25 hours a week plus the associated employer NICs and employer minimum automatic enrolment contributions (a maximum of about £6,500).

There is to be no cap on the cost of the scheme.

Traineeships

Employers who provide work experience for 16-24-year-olds in work placements and training will receive a payment of £1,000 per trainee. Provision of traineeships and eligibility for them will be extended to those with Level 3 qualifications and below, to ensure that more young people have access to training.

Payments for employers who hire new apprentices

Employers in England will receive a new payment of £2,000 for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over.

The scheme will run from 1 August 2020 to 31 January 2021. These payments will be made in addition to the existing £1,000 payment the Government already provides for new 16-18-year-old apprentices, and any of those aged under 25 with an Education, Health and Care Plan.

Other supporting jobs measures

Other initiatves were introduced in the Summer Statement to support jobs and these included:

£895 million to enhance work search support across Great Britain by doubling the number of work coaches in Jobcentre Plus before April 2021.

An additional £150 million in the funding for the Flexible Support Fund in Great Britain, including increased capacity for the Rapid Response Service.

£101 million for the 2020/21 academic year to give all 18-19-year olds in England the opportunity to study targeted high value Level 2 and 3 courses when there are not employment opportunities available to them.

£95 million in 2020/21 to expand the scope of the Work and Health Programme in Great Britain to introduce additional voluntary support in the autumn for those on benefits who have been unemployed for more than three months.

£40 million to fund private sector capacity to introduce a job finding support service in Great Britain in the autumn.

£32 million new funding for the National Careers Service.

Protecting Jobs

The Protecting Jobs element focuses on the hospitality and leisure sector, which saw over 80% of businesses temporarily cease trading in April and has over 1.4 million furloughed workers. It is a sector that employs over two million people, according to the Chancellor, which are disproportionately drawn from the young, women and people from Black, Asian and minority ethnic communities.

Temporary VAT cut for food and non-alcoholic drinks

A reduced 5% VAT rate will apply to supplies of food and non-alcoholic drinks from restaurants, pubs, bars, cafés and similar premises across the UK. This temporary rate will apply from 15 July 2020 to 12 January 2021. Further guidance on the scope of this relief will be published by HMRC in the coming days.

Temporary VAT cut for accommodation and attractions

The 5% rate of VAT will also apply from 15 July 2020 to 12 January 2021 to supplies of accommodation and admission to attractions across the UK. HMRC will publish further guidance on the scope of this relief in the coming days.

Eat Out to Help Out

The ‘Eat Out to Help Out’ scheme will be introduced to encourage people to return to eating out. Every diner will be entitled to a 50% discount of up to £10 a head on their meal, at any participating restaurant, café, pub or other eligible food service establishment.

The discount can be used without limit throughout the UK on any eat-in meal (including non-alcoholic drinks but excluding alcohol). It will be valid Monday to Wednesday during the month of August, and participating establishments will be fully reimbursed for the 50% discount. Participating establishments will be able to sign up via a dedicated website from 13 July.

Creating Jobs

The job creation measures the Chancellor announced are primarily targeted on the housing and construction sector. These included…

Stamp Duty Land Tax

Receipts of Stamp Duty Land Tax (SDLT – covering England and Northern Ireland) have fallen steeply in the past few months. The slowdown in transactions has been accompanied by a stalling in prices – the latest data from Nationwide showed house prices falling in June 2020 for the first time in almost eight years. A temporary cut in SDLT on residential properties was widely trailed and duly arrived.

From 8 July 2020 to 31 March 2021, there will be no SDLT on the first £500,000 slice of property value, creating a maximum saving of £15,000. However, the 3% additional rate will still apply to additional properties. The resulting revised SDLT table for residential property is shown below.

England and Northern Ireland – SDLT on slices of value from 8 July 2020 to 31 March 2021

| Residential Property | % |

|---|---|

| Up to £500,000 | 0 |

| £500,001 – £925,000 | 5 |

| £925,001 – £1,500,000 | 10 |

| Over £1,500,000 | 12 |

| Residential properties bought by companies etc. over £500,000: 15% of total consideration, subject to certain exemptions | |

| Additional residential and all corporate residential properties £40,000 or more – add 3% to relevant SDLT rate(s) | |

The rates of Land and Buildings Transaction Tax (LBTT) in Scotland and Land Transaction Tax (LTT) in Wales are set by the devolved administrations in those countries. In the past, they have tended to follow changes to SDLT with their own variations. At the time of writing, the devolved Governments had not made any announcements.

Green Homes Grant

A £2 billion Green Homes Grant will be introduced, providing at least £2 for every £1 up to £5,000 per household to homeowners and landlords who spend on making their residential properties more energy efficient. For those on the lowest incomes, the scheme will fully fund energy efficiency measures of up to £10,000 per household.

Other 'creating jobs' measures

Other initiatives included:

£5.6 billion of accelerated infrastructure investment, covering hospitals, schools, courts, prisons, town centre improvements and local road maintenance.

A £1 billion investment over the next year in a Public Sector Decarbonisation Scheme that will offer grants to public sector bodies, including schools and hospitals, to fund both energy efficiency and low carbon heat upgrades.

By boosting the Short-Term Home Building Fund, an additional £450 million in development finance will be made available to smaller firms that are unable to access private finance.

£400 million will be allocated via the Brownfield Housing Fund to seven Mayoral Combined Authorities to bring forward land for development of homes in England.

£100 million of new funding will be provided for researching and developing Direct Air Capture – a new clean technology that captures CO2 from the air.

A new Social Housing Decarbonisation Fund will be established to help social landlords improve the least energy-efficient social rented homes. It will start in 2020/21 with a £50 million demonstrator project.

£40 million will be spent to improve the environmental sustainability of the courts and tribunals estate in England and Wales, investing in initiatives to reduce energy and water usage.

Up to £40 million will be made available in a Green Jobs Challenge Fund for environmental charities and public authorities to create and protect 5,000 jobs in England. The jobs will involve improving the natural environment, including planting trees and creating green space for people and wildlife.

£10 million of funding is to be made available immediately to the Automotive Transformation Fund for the first wave of innovative R&D projects to scale up manufacturing of the latest technology in batteries, motors, electronics and fuel cells.

New legislation will be introduced in summer 2020 to make it easier to convert buildings for different uses, including housing, without the need for planning permission. In July 2020, the Government will launch a policy paper setting out its plan for comprehensive reforms of England’s planning system.

Further thoughts

As always, the devil is in the detail. As the Treasury begins to release the papers behind the Chancellor’s headlines, the Shipleys team will be closely monitoring what these mean for our clients. We’ll be sharing our conclusions and advice here on our website and in our conversations with clients.

In the meantime, if you wish to discuss how the Summer Statement will impact on you, please do talk with your usual Shipleys’ contact or one of our offices.

This summary is based on the Chancellor’s Summer Statement on 8 July 2020, supplemented by information from official publications.

It reflects our understanding of proposed changes to tax law and practice at the date of publication, but is not a complete and definitive guide. The Government's proposals may be amended.

Specific advice should therefore be obtained before taking action, or refraining from taking action, on the basis of this information.

© 2020 Shipleys LLP